September is for Starting

Have you ever received a gift card or money windfall and you felt pressured to spend it “the right way” or on something super special?

You either overthink it, save it forever, or use it on groceries you already buy every week, even though part of you wants to treat yourself. Or you blow it on something you later regret.

Here’s a better way: plan ahead by deciding in advance.

Make a list of what you’d really want to spend extra money or a gift card on, with no guilt or stress, just intention.

Making lists like this is a useful way to see how your desires shift once you’re out of the moment and able to think about these types of things with your whole life in mind.

And it goes beyond gift cards.

-

Which streaming services would you actually watch, not just because they’re on sale?

-

What kinds of clothing or household replacements would really be useful?

-

What classes would you most love to take?

-

Which memberships or tickets would be most exciting?

-

Where would putting extra cash make the biggest difference?

Get your own worksheet to guide you through curating a list:

July 16th - Make a list for gift cards

It doesn’t matter if it’s the 2nd or the 28th…you can always jump back in.

Do circumstances have you feeling like you’ve fallen off your financial plan this month?

-

Stopped tracking your expenditures?

-

Skipped the extra payment?

-

Life felt complicated so you ditched your plan?

It happens. Following a plan is a process, and the longer you do it the more you’ll build your plan-following muscles. In the meantime, you can recommit at any time.

-

You don’t need a Monday.

-

You don’t need a new month.

-

You can take ANY moment and start up again…including right now.

Download today's worksheet and create checkpoints for recommitting:

July 15th - Where do you need to recommit?

Go back to the July is Money Month homepage.

Struggling to stay motivated with your financial plan? Numbers alone won’t always keep you going, but meaning will.

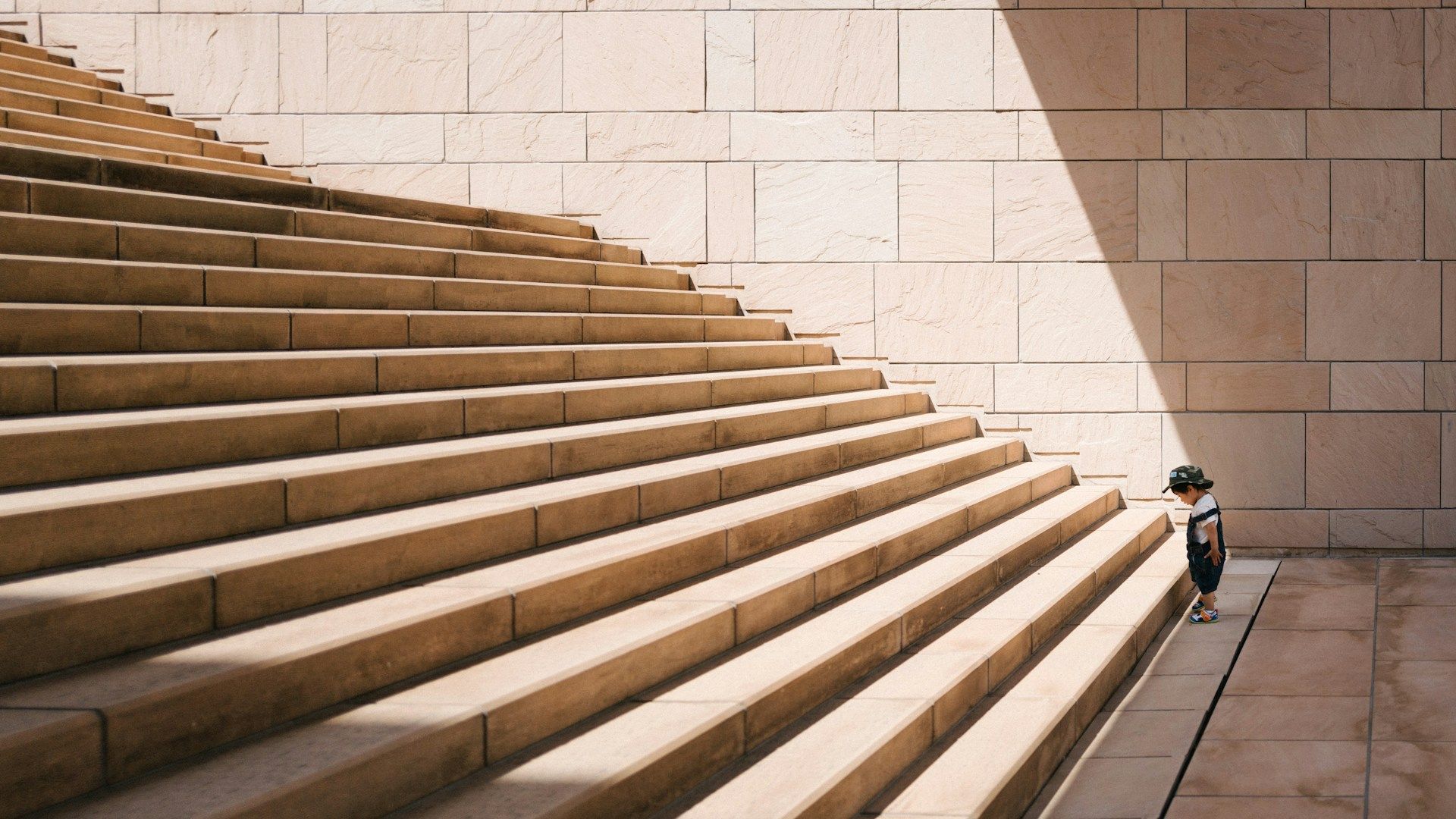

That’s why visual reminders are so powerful. They keep your “why” in sight, even on the hard days.

Whether it’s a full vision board or something small and personal, visual cues can help you stay connected to your goals.

Not into crafting a board? No problem — there are lots of simple ways to make your motivation visual.

-

A sticky note on your mirror

-

A charm on your keyring

-

A photo on your phone lock screen

-

A savings tracker you color in

-

A note in your wallet that reminds you what you’re working toward

Want more ideas? Download today's worksheet and learn what you can do to make your mission front and center in your field of vision:

July 14th - Make your motivation visual

Go back to the July is Money Month homepage.

Money doesn’t have to feel stressful, scary, or shameful. Sometimes, it just needs a better soundtrack.

Here are a few empowering money lyrics from songs that remind us to feel strong, capable, and in control:

-

“I see it, I like it, I want it, I got it.” — Ariana Grande

-

“I wanna be a billionaire so frickin’ bad.” — Travie McCoy & Bruno Mars

-

“She works hard for the money, so you better treat her right.” — Donna Summer

-

“I'm not rich, but I'm not broke.” — Jessie J

-

“If I had a million dollars, I’d be rich.” — Barenaked Ladies

Want the full list of songs that help you feel good about money and motivated to stick to your goals? It's here!

July 13th - A money playlist...for funsies